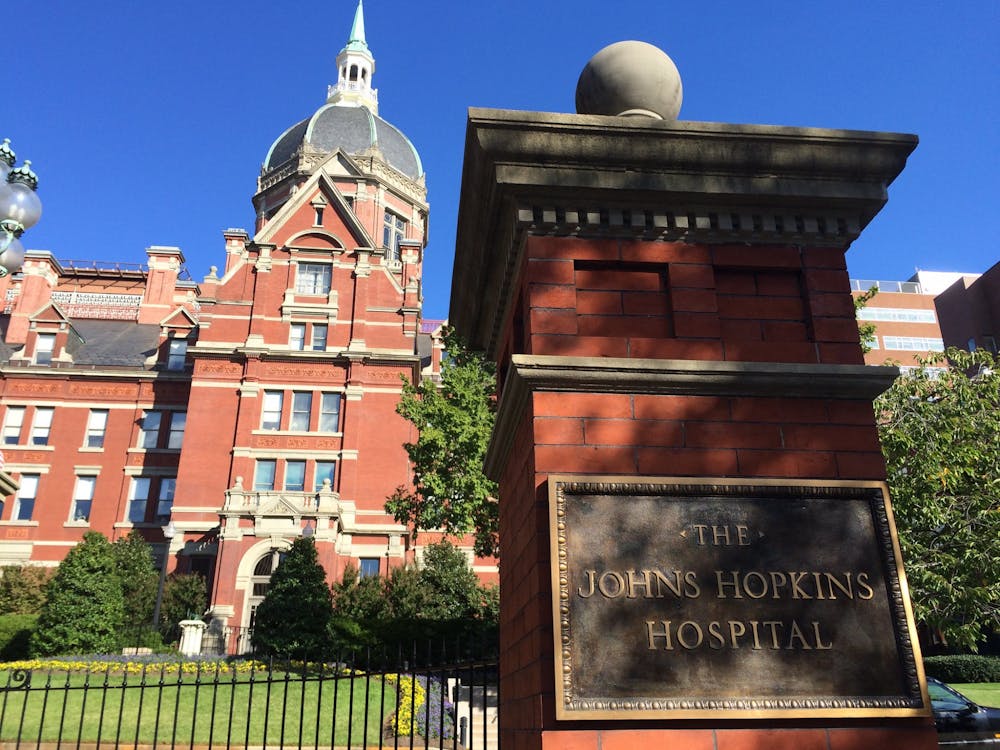

Hopkins researchers published a new study in Health Affairs, where they analyzed the charity care missions of U.S. nonprofit hospitals. They discovered a negative association with trustee compensation.

U.S. nonprofit hospitals do not pay property tax, federal or state income tax or sales tax. It is estimated these tax benefits total $28 billion yearly for all nonprofit hospitals. However, in exchange for these tax benefits they receive from the Internal Revenue Service (IRS), nonprofit hospitals are required to advance a charitable mission.

For a nonprofit, the Board of Trustees makes the main management decisions and controls the organization’s policies with the goal of contributing to the nonprofit’s charitable mission. Out of the 2,058 U.S. nonprofit hospitals, 37.3% of nonprofit hospitals compensated their trustees while 62.7% did not. By examining IRS data, this study found that there was a statistically significant decrease in charity care for nonprofit hospitals that compensated their trustees.

Professor of Accounting at Carey Business School and Professor of Health Policy and Management at Bloomberg School of Public Health Ge Bai is the lead author of this paper. She discussed the team’s research in an interview with The News-Letter.

“Historically, hospitals were all charities; there were no for-profit hospitals. Now, they have to compete with these for-profit hospitals,” she said.

One aspect of this study looked at how the amount provided by charity care changed with time. The team chose to focus on charity care because it more accurately measures the hospital's advancement of its mission as opposed to other forms, which can be manipulated.

“Doing unsponsored research and education is also considered contributing to the community,“ Bai said. “The IRS also says uncompensated Medicaid costs are considered contributions to community benefit, but we focused on charity care because it is the most aligned with the charitable mission. Other components are more gameable.”

In the study, researched looked at IRS data from Form 990, a mandatory filing for all nonprofit hospitals. By taking a ratio of the money spent on charity care versus the total expenses of the hospital, the team was able to compare nonprofit hospitals. Based on data from 2011 to 2019, the study showed that across all nonprofit hospitals, the average charity-care-to-expense ratio decreased by 21%.

In addition to studying how hospitals changed with time, the study analyzed trustee compensation using the same IRS forms. In 2011, there was no statistically significant difference in charity care based on trustee compensation. However, by 2019, nonprofit hospitals that compensated their trustees had a lower charity-care-to-expense ratio of 1.6% compared to hospitals that did not, which had a ratio of 2.2%.

The team also did a regression analysis that found that, on average, for every $10,000 increase in average trustee compensation, there was an associated decrease of 0.02% in their charity care ratio. The amount was about $66,000 to $77,000 of charity for the average-sized hospital.

Although this research does not imply any causality between trustee compensation and charity care, Bai hopes this motivates nonprofit hospitals to examine their own trustee compensation and charity care eligibility. Each individual hospital determines who is eligible for charity care and whether that covers underinsured individuals or is limited to uninsured individuals. By creating a more generous policy, nonprofits can increase their charity care ratio and further their mission.

Bai highlighted that these findings can help the public question why certain hospitals pay their trustees so much. The trustees control the charity care policies which could suggest an explanation for the study’s findings.

“If nonprofit hospitals pay their trustees a lot of money, that could raise a red flag. It could pose the question of whether they are attracting mission-oriented people or profit-oriented people. These leaders have important implications for the hospital’s behavior,” she said.

In the future, Bai aims to design legislation and policies to ensure nonprofit hospitals are providing sufficient charity care provisions to deserve their tax-exempt status. Bai explained the charity that nonprofit hospitals provide not only improves the social well-being of their community but also helps the economy.

“There is a social contract between nonprofit hospitals and taxpayers. Taxpayers give hospitals subsidies, but they also expect that they should help vulnerable Americans so that they can keep working and being productive citizens,” she said.