Donald Trump has marketed himself as the business-savvy candidate throughout his brief political career. Many of his supporters cling to the belief that he possesses the business experience — and not the career politics — needed to rejuvenate the American economy. In the second GOP debate, Trump used his opening remarks to introduce himself as a financially successful candidate.

“I’m Donald Trump... I’ve made billions and billions of dollars dealing with people all over the world, and I want to put whatever that talent is to work for this country so we have great trade deals, we make our country rich again, we make it great again,” Trump said.

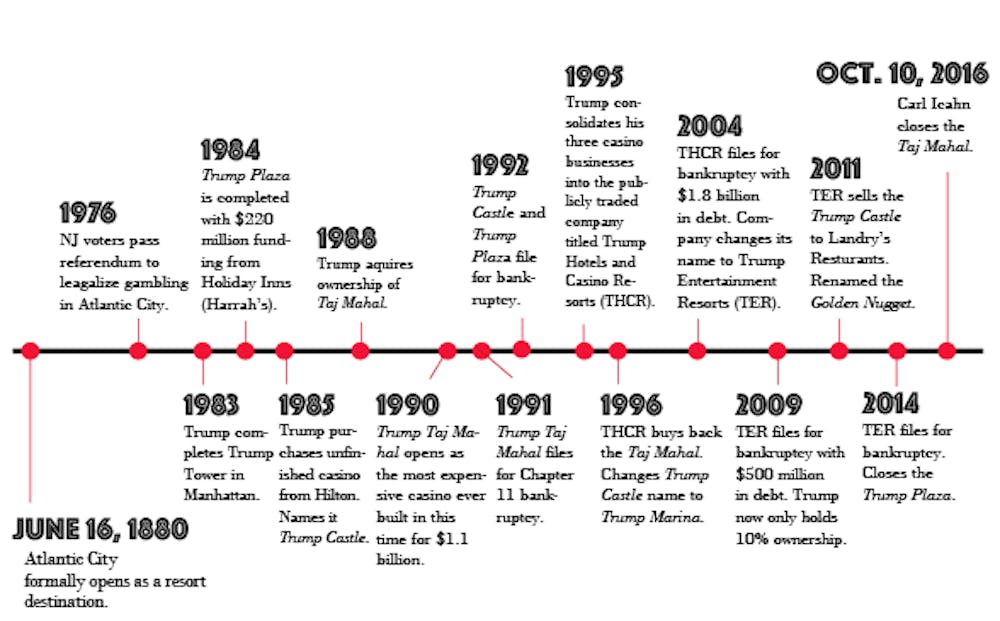

One place Trump cultivated his “billions and billions” was Atlantic City, N.J. where he opened three casinos: The Trump Plaza, Trump Castle and the Trump Taj Mahal. But today, the dazzling, illuminated signs that once spelled his name have been scraped off the Trump Plaza’s boardwalk facade, leaving behind a grimey, salt-stained outline.

The Trump Taj Mahal, the last remaining casino of Trump’s original three that still bared his name, shut down on Oct. 10, laying off about 3,000 employees. Trump no longer owned the Taj Mahal, but this marked the last time his name would dot the city’s skyline.

After filing for Chapter 11 bankruptcy six times during his time in Atlantic City, Trump leaves behind a city in economic turmoil.

Atlantic City currently experiences an unemployment rate of 7.1 percent, far exceeding the national average of 5.0 percent according to the Bureau of Labor Statistics. The Press of Atlantic City recently reported that the city must close a roughly $44 million debt without further state aid to balance the 2017 budget. The Press also reports that N.J. state administration rejected the city’s five-year fiscal recovery plan on Nov. 1. The city now faces potential state takeover.

Although it still lacks a self-sustainable business model, Atlantic City wasn’t always in financial distress. After the state’s residents voted to legalize gambling in the city in 1976, Atlantic City ushered in an economic boom similar in glitz and glamour to the Roaring Twenties.

In their 1997 analysis “Gambling on Jobs and Welfare in Atlantic City,” Ted G. Goertzel, a sociology professor at Rutgers University-Camden, and John W. Cosby, director of the Atlantic County Department of Community Development and Economic Assistance, reported that the initial success of the gambling industry expanded the area’s job market.

“In the late 1970s and early 1980s, when new casinos were opened one after another, Atlantic City was a boom town where no one who was willing and able to work could claim that no job was available,” the report states.

Trump and many other businessmen rushed to the gold-plated tables to place their bets. He opened Harrah’s at Trump Plaza first in 1984, after partnering with the gambling unit of Holiday Inns. Harrah’s provided Trump with $220 million in financing, but this later proved to be an ill-devised partnership.

Trump then slid his chips from the boardwalk to the marina district, purchasing a nearly completed casino from Hilton for $320 million. In 1985, he christened this casino Trump Castle. He then competed directly against his partner’s venture, Harrah’s Marina casino. Harrah’s ended the partnership and sold its shares to Trump, leaving his name as top billing on the Plaza.

In a 1985 New York Times article, Trump commented on his relationship with Harrah’s.

“I gave them a Lamborghini, and they didn’t know how to turn on the key,” Trump said.

After battling for ownership against television talk show host Merv Griffin, Trump gained ownership of the unfinished Taj Mahal casino in 1988; He called this concrete imitation of the original Indian mausoleum “The Eighth Wonder of the World.” The project got expensive fast.

In order to finish construction, Trump issued $675 million in junk bonds with 14 percent interest rates. After slapping on its owner’s name, the Trump Taj Mahal opened in 1990 as the largest, most expensive casino, having cost about $1 billion.

During this time, there were few who questioned Trump’s impulsive practices. In 1990, however, Marvin Roffman, a veteran securities analyst who focused on the gaming industry, noticed the impossible sustainability of Trump’s business practices.

“Well, why would you want to have three casinos? One is going to cannibalize the other,” Roffman said in a recent interview with ABC News’ Nightline.

A year after its star-studded opening, the Trump Taj Mahal filed for bankruptcy in 1991. Trump’s other casinos soon started to fold. The Trump Plaza and Trump Castle followed suit, both filing for bankruptcy in 1992.

In 1995, Trump consolidated his casino businesses under the publicly traded company Trump Hotels and Casino Resorts. The New York Times recently published Trump’s tax returns from this same year, showing that Trump claimed a $916 million loss. In the first presidential debate, he refused to deny claims that he avoided paying federal income taxes.

In 2004, Trump Hotels and Casino Resorts filed for bankruptcy with $1.8 billion in debt and the company changed its name to Trump Entertainment Resort. The company filed for bankruptcy in 2009 and again in 2014, resulting in the Trump Plaza’s closure.

After emerging from bankruptcy in 2016, Trump Entertainment Resorts became an owned subsidiary of Icahn Enterprises. The Trump Taj Mahal casino was taken over by Carl Icahn, a billionaire investor, but after a labor strike, Icahn decided to close. The Taj Mahal had its final night of operation on the same night as the second presidential debate.

As election day approaches, both candidates have released their tax plans. A recent analysis from the Urban Brookings Tax Policy Center (TPC), estimates that Clinton’s proposals would increase federal revenue $1.4 trillion over the first decade. After including interest savings, the proposals would decrease the debt $1.6 trillion over the first 10 years. Nearly all of the revenue gain would come from individual income tax changes that affect the top-earning one percent of households.

Eerily similar to his previous ventures in Atlantic City, TPC predicts that Trump’s proposed tax plan would create short term success but long-term repercussions.

Trump’s plan would reduce the federal debt by $6.2 trillion over the first decade of implementation but increase the federal debt by $7.2 trillion by 2026. The plan would also cut taxes at every income level, but high income taxpayers would receive the biggest cuts, both in dollar terms and as a percentage of income.